What to know about a soft credit check

Credit scores are often complex, and as a renter, it's important to understand how credit will impact your housing experience. We've listed ten facts you need to know about your credit score to ensure you're setting yourself up to land your next dream apartment.

[.blog-disclaimer-text]Disclaimer: This article is not legal advice. Any legal information is not the same as legal advice, where an attorney applies the law to your specific circumstances, so you should consult an attorney if you’d like advice on your interpretation of this information or its accuracy. You may not rely on this article as legal advice, nor as an endorsement of any particular legal understanding.[.blog-disclaimer-text]

When it comes to renting an apartment, the terms "soft credit check" and "hard credit check" frequently surface, leaving many renters perplexed about what these checks entail and how they impact creditworthiness. In this blog, we’ll explore soft credit checks, the factors that influence them, and the impact they have on renting your next dream home.

What to know about credit scores

Credit scores are a crucial financial metric that impact several aspects of your financial life. From the range to the various factors that contribute to your credit score, here are the fundamentals about credit scores every renter should be aware of:

Credit score range

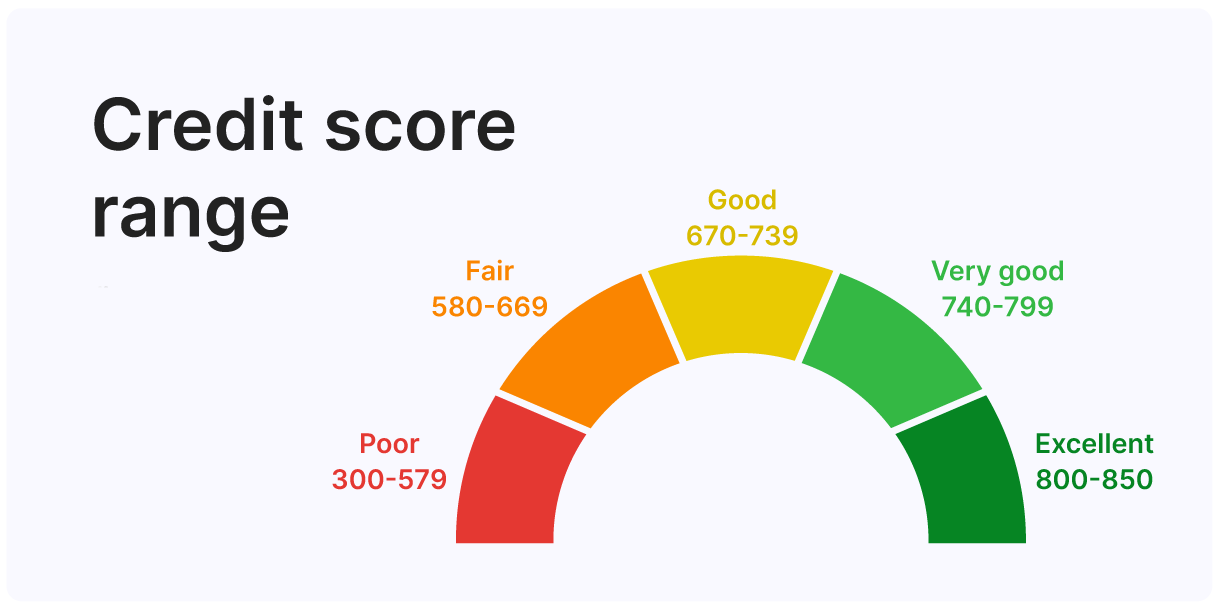

A fundamental aspect of credit literacy is understanding the credit score range. Credit scores commonly range from 300 to 850, with higher scores signaling better creditworthiness. Scores can be broadly categorized as poor (300-579), fair (580-669), good (670-739), very good (740-799), and excellent (800-850). This range gives landlords a snapshot of your financial health and how likely you are to fulfill your financial obligations as a tenant.

Factors that contribute to your score

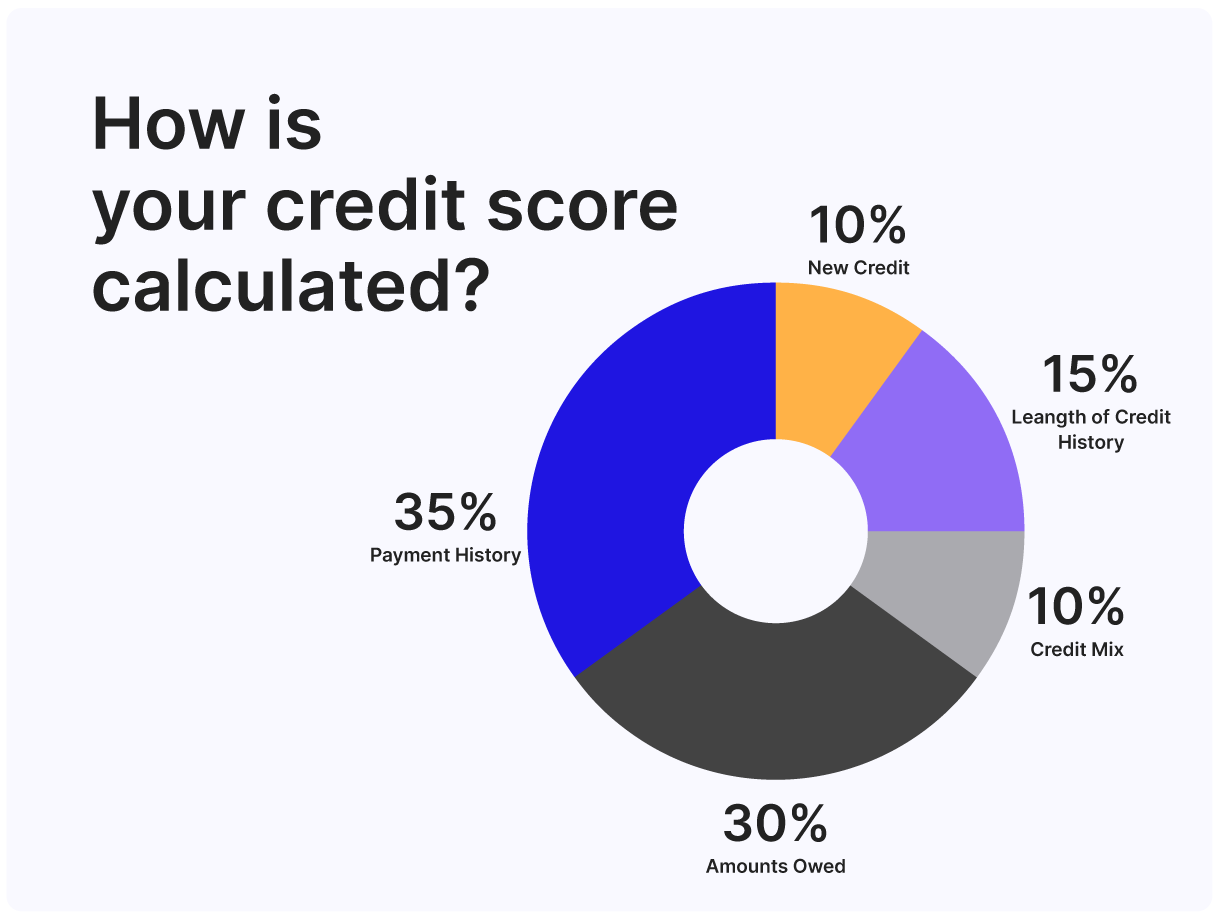

Numerous factors contribute to your credit score and understanding these factors can help you strengthen your score. These factors include:

Payment history: This data paints a good picture of whether or not you've consistently paid your bills on time.

Credit utilization: Measures how much of your available credit you're using. Keep in mind, maintaining a low credit utilization ratio indicates responsible credit management.

Credit history: The length of your credit history is another consideration, with longer histories generally viewed more favorably.

The types of credit you use, such as credit cards, mortgages, and installment loans, contribute to the diversity of your credit profile. Lastly, opening new credit accounts can impact your score, with multiple recent inquiries potentially suggesting financial instability.

What landlords are looking for

Landlords scrutinize credit reports to assess an applicant's financial responsibility and reliability. They are particularly interested in a tenant's:

Payment history

Your payment history highlights how consistently you meet your financial obligations. Landlords are keen on tenants who have a history of timely payments, as it reflects a reliable and trustworthy financial track record.

Outstanding debts and any adverse credit events

Any outstanding debts or adverse credit events, such as bankruptcies or foreclosures, are also reviewed since they can indicate financial challenges that may impact a tenant's ability to meet rent obligations.

A closer look: hard vs. soft credit checks

Each time a landlord looks at someone's credit history when conducting a tenant verification, they initiate a credit inquiry from one or all three of the credit bureaus: TransUnion, Experian, and Equifax.

Although all inquiries on your credit are sourced from the same information, be aware that not all inquiries are created equal. Here’s how soft credit checks differ from hard credit checks:

Soft credit checks:

Soft credit checks, also known as soft pulls or inquiries, provide a limited view of your credit report. They are typically initiated for background checks, pre-approval processes, or by individuals or entities with whom you have an existing relationship.

Soft inquiries do not impact your credit score and only require you to provide your name and address rather than personally identifiable information (PII) like your social security number or date of birth. When agents perform soft inquiries to verify you as a tenant, you don’t have to worry about it impacting your score like a hard inquiry would.

A soft credit check provides creditors with an indication of how risky of a borrower you are. Some of the most common soft inquiry examples include pre-qualified credit card offers, background checks for employment, and, notably for renters, apartment or housing rental applications. It's important to note that while soft inquiries don't affect your credit score, they are still recorded on your credit report for informational purposes and will disappear in 30 days.

Hard credit checks:

Hard credit checks, or hard pulls, are more comprehensive and usually occur when you apply for credit, such as a credit card, loan, or mortgage through a financial institution. They show the same information as soft pulls but also include additional details such as account balances and your payment history.

When you fill out an application for an apartment, most property representatives run a hard credit inquiry which can potentially affect your credit score by up to five points for each application submitted. While five points may not seem like much, it can add up. If you apply for ten different apartments, for example, your score may decrease between 25 and 50 points. Plus, hard inquiries show up on your report for up to two years, which can give lenders pause when determining whether to grant you a loan.

Hard credit checks can be particularly challenging for younger apartment renters who may not have a stable or lengthy credit history. Without a consistent credit track record, initiating multiple hard apartment rental inquiries can jeopardize your ability to get a home mortgage or even an auto loan down the road.

Unlike soft credit checks, the Fair Credit Reporting Act requires credit bureaus to inform you when a hard inquiry is performed on your credit report. In addition, before running a hard inquiry credit check, landlords must ask you to sign a credit screening document.

Do apartments run hard or soft credit checks?

Most apartment rental applications involve soft credit checks. Landlords are generally interested in assessing your financial responsibility and suitability as a tenant rather than conducting an in-depth examination of your credit history.

Does a soft credit check affect your credit?

Unlike hard inquiries, which typically occur when you apply for credit or loans, soft pulls are conducted for informational purposes and do not affect your credit rating. Soft pulls are only visible to you and not to potential lenders who review your reports. Authorizing a soft credit check is a low-risk decision that provides landlords a way to gather the necessary information to evaluate your rental application. Plus, soft credit checks can give you a sense of whether or not you're a good candidate for an application. Once you get the green light from a landlord or property representative, you can proceed with the full application where you will be subject to a hard inquiry.

Special considerations

If you're concerned about the potential impact of hard inquiries on your credit score, there are a few steps you can take to minimize any negative effects:

Be selective with applications

Only submit rental applications for properties you're genuinely interested in and know you are pre-approved for based on your soft credit inquiry. Each hard inquiry can have a minor impact on your credit score, and submitting multiple applications within a short period may compound this effect.

Communicate with landlords

Before formally applying for a rental, consider discussing your application with the landlord to determine if you’re a viable candidate before proceeding with the complete application process. Share relevant information about your creditworthiness, rental history, and any other factors that might strengthen your application. Transparent communication can help landlords make more informed decisions and potentially reduce the need for multiple applications.

Time your applications wisely

If possible, space out your rental applications. Since hard inquiries have a temporary impact, spreading them out over time can minimize the short-term effect on your credit score. For example, if you apply for a rental at the beginning of the month, try to wait a few weeks before applying for the next.

Check credit requirements

Before applying for a rental, understand the average credit score the landlord is looking for to help you gauge whether your application is likely to be successful.

Use a rental platform with soft checks

Consider using rental platforms that offer pre-screening services using soft credit checks. Platforms like RentSpree allow landlords to assess your creditworthiness without significantly affecting your credit score.

Monitor your credit report

Regularly check your credit report for accuracy and to keep track of any hard inquiries. If you notice any inaccuracies or unauthorized inquiries, dispute them with the credit reporting agencies.

Remember that while hard inquiries can have a temporary impact, they are just one factor among many that landlords consider. A strong rental history, stable income, and positive references can also contribute significantly to a successful rental application.

Learn what credit score you need to rent your next dream apartment

As you gear up to apply for your dream apartment, it’s essential to have a realistic understanding of the credit score you need. According to Experian’s Q2 2023 Consumer Credit Review, the average credit score is 716. While specific requirements may vary, landlords often prefer tenants with good to excellent credit scores.

Generally, a score above 700 is generally considered favorable, reflecting a history of responsible financial behavior while a score of 800 or higher is considered stellar. Anything between 601 and 660 is fair but lower than that can make it harder for you to rent a home because it may indicate a history of financial challenges such as late payments, high credit card balances, past defaults, or other negative marks on the credit report. If your credit score falls out of the desired range, there are still several ways you can minimize these challenges and improve your credit score to improve your candidacy before you apply.

Embark on your apartment-hunting journey with confidence

To secure your next rental, it’s wise to learn the ins and outs of soft credit checks so that you can navigate the application process more effectively. When you know what your score is, you can strategically manage your credit and increase your chances of stepping into your next apartment with ease.

Once you've got a firm understanding of how soft and hard inquiries work and a good grasp of your credit score, take the next step and apply to your dream home today. Try Rent Spree’s Rental Application now.